45 how to determine coupon rate

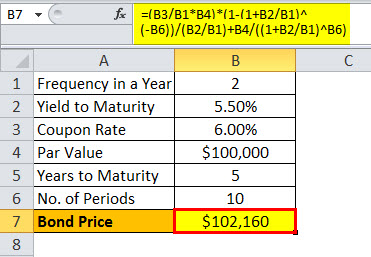

How to Calculate the Yield of a Zero Coupon Bond Using ... That's gonna allow us to calculate just that so let's jump into an example and I'll show you how it works. So let's say that you didn't know the yield on a five-year zero-coupon bond but you did know the forward rates here I've got the forward rates for the next five years so you've got these different forward rates here and you can essentially just plug them into this formula above and we can ... Bond Price Calculator c = Coupon rate n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate t = No. of years until maturity After the bond price is determined the tool also checks how the bond should sell in comparison to the other similar bonds on the market by these rules:

Coupon Rate Formula | Calculator (Excel Template) Coupon Rate is calculated using the formula given below Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100 For Secured NCDs Coupon Rate = (89 / 1000) * 100 Coupon Rate= 8.9% For Unsecured NCDs Coupon Rate = (91 / 1000) * 100 Coupon Rate= 9.1%

How to determine coupon rate

Coupon Rate: Formula and Bond Nominal Yield Calculator The formula for the coupon rate consists of dividing the annual coupon payment by the par value of the bond. Coupon Rate = Annual Coupon / Par Value of Bond For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000 Coupon Rate = 6% Annual Coupon = $100,000 x 6% = $6,000 Coupon Rate Definition - investopedia.com A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000... Discount Rate Formula | How to calculate Discount Rate ... Discount Rate is calculated using the formula given below Discount Rate = T * [ (Future Cash Flow / Present Value) 1/t*n - 1] Discount Rate = 2 * [ ($10,000 / $7,600) 1/2*4 - 1] Discount Rate = 6.98% Therefore, the effective discount rate for David in this case is 6.98%. Discount Rate Formula - Example #3

How to determine coupon rate. What Is a Coupon Rate? How To Calculate Them & What They ... Let's take a look at the formula for calculating the coupon rate and how we can apply them. Simple Formula C = I/P Where: C = coupon rate I = annualized interest P = par value The coupon rate is the rate by which the bond issuer pays the bondholder. How to Calculate an Interest Payment on a Bond: 8 Steps To calculate the interest payment on a bond, look at the bond's face value and the coupon rate, or interest rate, at the time it was issued. The coupon rate may also be called the face, nominal, or contractual interest rate. Multiply the bond's face value by the coupon interest rate to get the annual interest paid. Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100% You are free to use this image on your website, templates etc, Please provide us with an attribution link How is coupon rate determined? - AskingLot.com How is coupon rate determined? A bond's coupon rate can be calculated by dividing the sum of the security's annual coupon payments and dividing them by the bond's par value. For example, a bond issued with a face value of $1,000 that pays a $25 coupon semiannually has a coupon rate of 5%. Click to see full answer.

Yield Calculation for a 10-Year Treasury Note - sapling Current yield simply is the annual interest amount that a bond pays divided by the current price of the bond. For example, if you buy a bond with a $1,000 face value and an interest rate -- also known as the coupon rate -- of three percent, you'll earn $30 per year in interest. Advertisement how to calculate coupon rate - OpenTuition In the first case, we know the coupon rate and the redemption amount, so we discount each year at the relevant interest rate to get the market value (as the examiner has done in his answer - appreciate that, for example, multiplying by 1.0446^ (-2) is another way of writing 1/ (1.0446^2), which is discounting for 2 years at 4.446%. › terms › fFloating-Rate Note (FRN) Definition Apr 30, 2021 · A floating-rate note is a bond that has a variable interest rate, vs. a fixed-rate note that has an interest rate that doesn't fluctuate. The interest rate is tied to a short-term benchmark rate ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! Bond Coupon Rate Calculator

Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The upper mentioned $323.01 is the actual cost of the 10 years' maturity coupon with a 20% interest rate and $2000 face rate. There is another zero-coupon bond example if the face value is $4000 and the interest rate is 30%, and we are going to calculate the price of a zero-coupon bond that matures in 20 years. Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Posted by Dinesh on 27-06-2021T07:56 This calculator calculates the coupon rate using face value, coupon payment values. › discounting-formulaDiscounting Formula | Steps to Calculate Discounted Value ... Coupon frequency= semi-annually; 1 st Settlement date=1 st Jan 2019; Coupon Rate=8.00%; Par Value=$1,000; The Spot rate in the market Spot Rate In The Market Spot Rate' is the cash rate at which an immediate transaction and/or settlement takes place between the buyer and seller parties. This rate can be considered for any and all types of ...

corporatefinanceinstitute.com › rate-functionRATE Function - Formula, Examples, How to Use RATE Function For a financial analyst, the RATE function can be useful to calculate the interest rate on zero coupon bonds. Formula =RATE(nper, pmt, pv, [fv], [type], [guess]) The RATE function uses the following arguments: Nper (required argument) – The total number of periods (months, quarters, years, etc.) over which the loan or investment is to be paid.

How do you calculate the PMT of a bond? - FindAnyAnswer.com Multiply the bond's coupon rate by its par value to determine its annual interest. In this example, multiply 5 percent, or 0.05, by $1,000 to get $50 in annual interest. Divide the bond's annual interest by its priceto convertthe priceto a yield. In this example, divide $50 by $1,048.90 to get 0.0477.

How does the U.S. Treasury decide what coupon rate to ... Answer (1 of 3): The coupon is usually set close to yield within typical rates i.e. 1/16th or 1/32 to generate a near par price. Trading too far away from par will either raise less money or reduce the appetite for investors if it is purchased way above par. The new issue or on-the-run can also ...

› present-value-formulaPresent Value Formula | Step by Step Calculation of PV The discount rate is denoted by r. Next, determine the number of periods for each of the cash flows. It is denoted by n. Next, calculate the present value for each cash flow by dividing the future cash flow (step 1) by one plus the discount rate (step 2) raised to the number of periods (step 3).

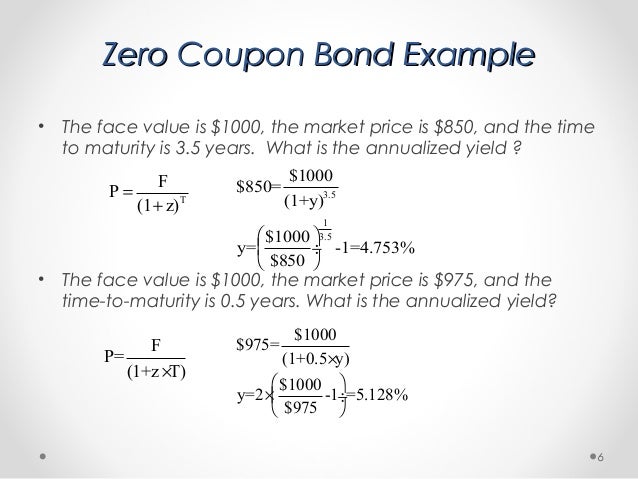

Zero-Coupon Bond: Formula and Excel Calculator Zero-Coupon Bond Price Formula. To calculate the price of a zero-coupon bond - i.e. the present value (PV) - the first step is to find the bond's future value (FV), which is most often $1,000. The next step is to add the yield-to-maturity (YTM) to one and then raise it to the power of the number of compounding periods.

Yield to Maturity vs. Coupon Rate: What's the Difference? To calculate the bond's coupon rate, divide the total annual interest payments by the face value. In this case, the total annual interest payment equals $10 x 2 = $20. The annual coupon rate for...

Coupon Rate of a Bond (Formula, Definition) | Calculate ... The coupon rate of a bond can be calculated by dividing the sum of the annual coupon payments by the par value of the bond and multiplied by 100%. Therefore, the rate of a bond can also be seen as the amount of interest paid per year as a percentage of the face value or par value of the bond. Mathematically, it is represented as,

How to Calculate a Coupon Payment: 7 Steps (with Pictures) If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment is .08 * 1000 or $80. 2

Post a Comment for "45 how to determine coupon rate"