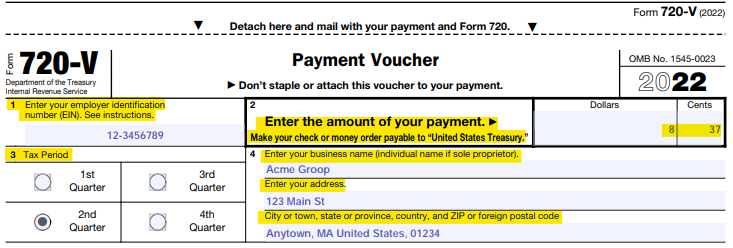

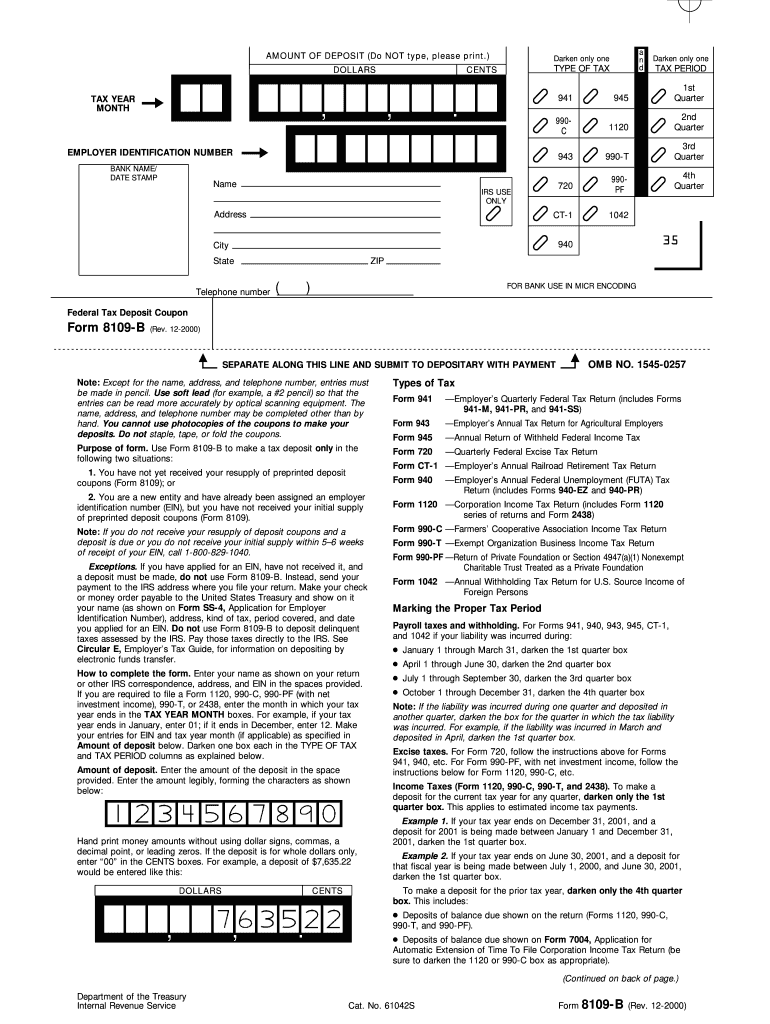

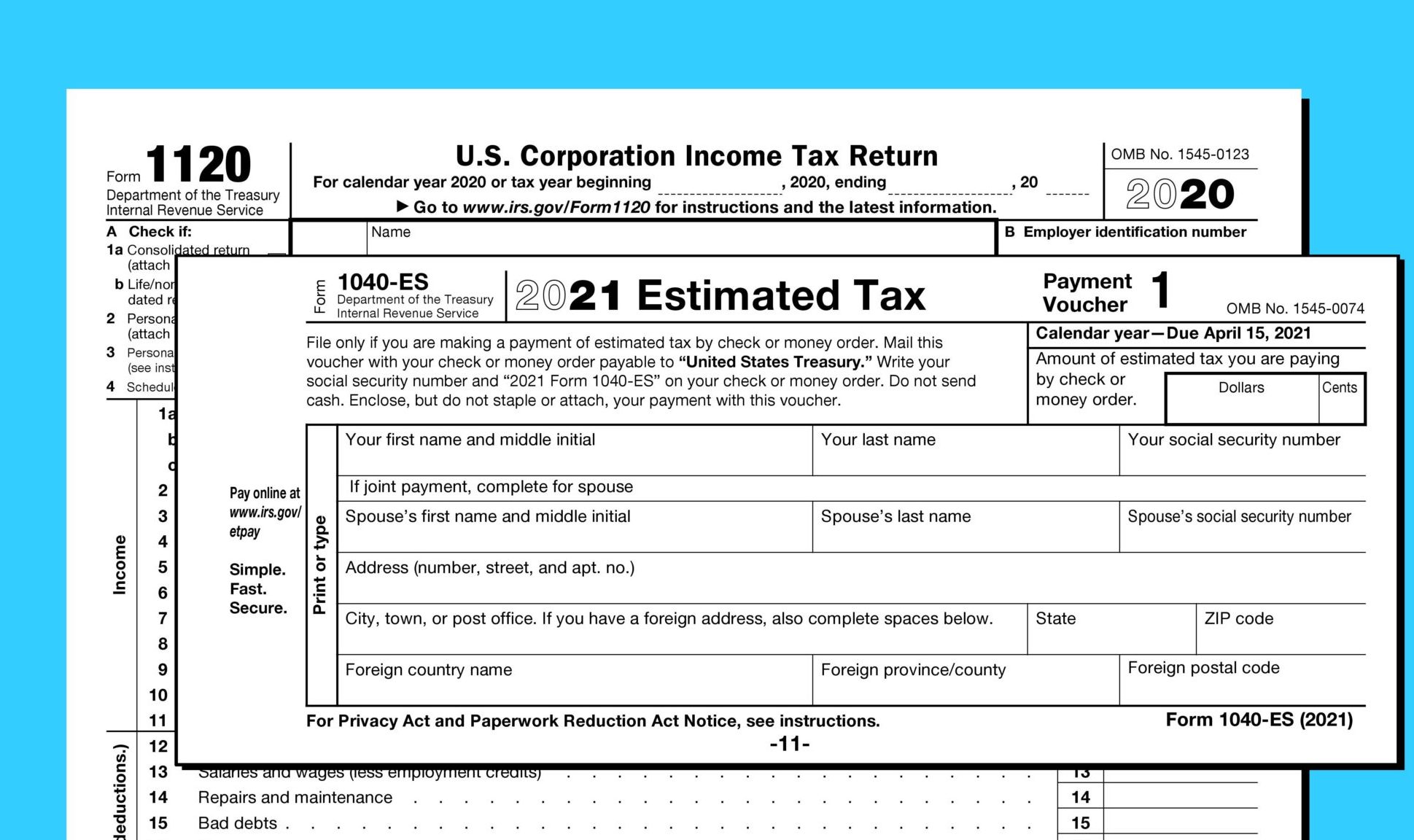

38 irs quarterly payment coupon

IRS Operations During COVID-19: Mission-critical functions ... Oct 13, 2022 · Taxpayers can ask for a payment plan with the IRS by filing Form 9465. Taxpayers can download this form from IRS.gov and mail it along with a tax return, bill or notice. Some taxpayers can use the online payment agreement application to set up a monthly payment agreement without having to speak to the IRS by phone. Publication 535 (2021), Business Expenses | Internal Revenue ... Comments and suggestions. We welcome your comments about this publication and your suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

Publication 15-A (2022), Employer's Supplemental Tax Guide 2022 withholding tables. The discussion on the alternative methods for figuring federal income tax withholding and the Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members are no longer included in Pub.15-A. This information is now included in Pub. 15-T

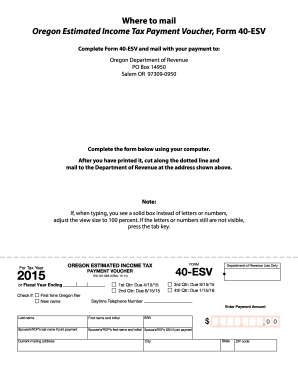

Irs quarterly payment coupon

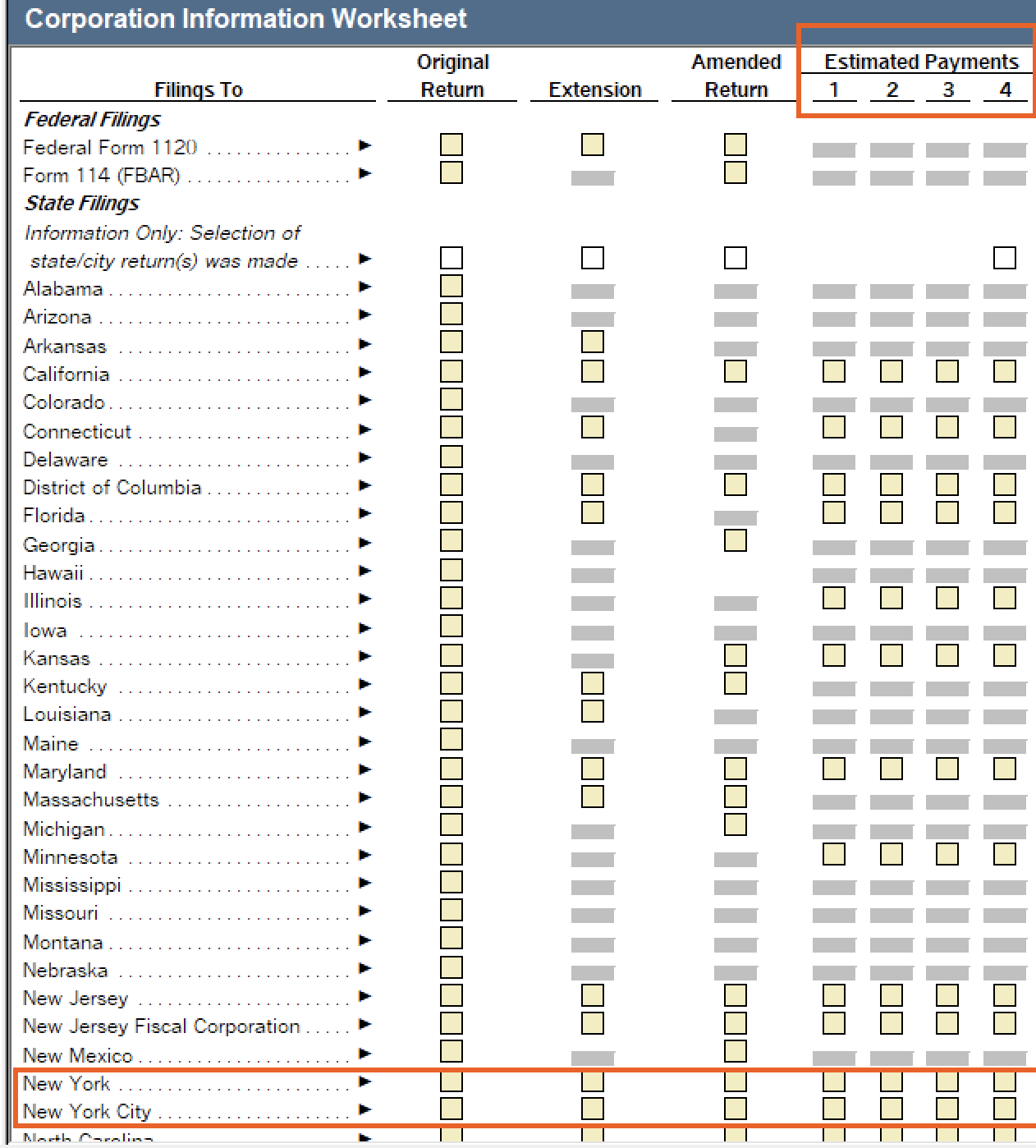

Publication 17 (2021), Your Federal Income Tax | Internal ... See payment plan details or apply for a new payment plan. Make a payment, view 5 years of payment history and any pending or scheduled payments. Access your tax records, including key data from your most recent tax return, your economic impact payment amounts, and transcripts. View digital copies of select notices from the IRS. Payments | Internal Revenue Service - IRS tax forms 4 oct. 2022 · Pay your taxes, view your account or apply for a payment plan with the IRS. Service Outages: Check Back Later This service is having outages that may keep you from successfully completing your session. Check back later. ... Employer's Quarterly Federal Tax Return Form W-2; Employers engaged in a trade or business who pay compensation Publication 550 (2021), Investment Income and Expenses ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224.

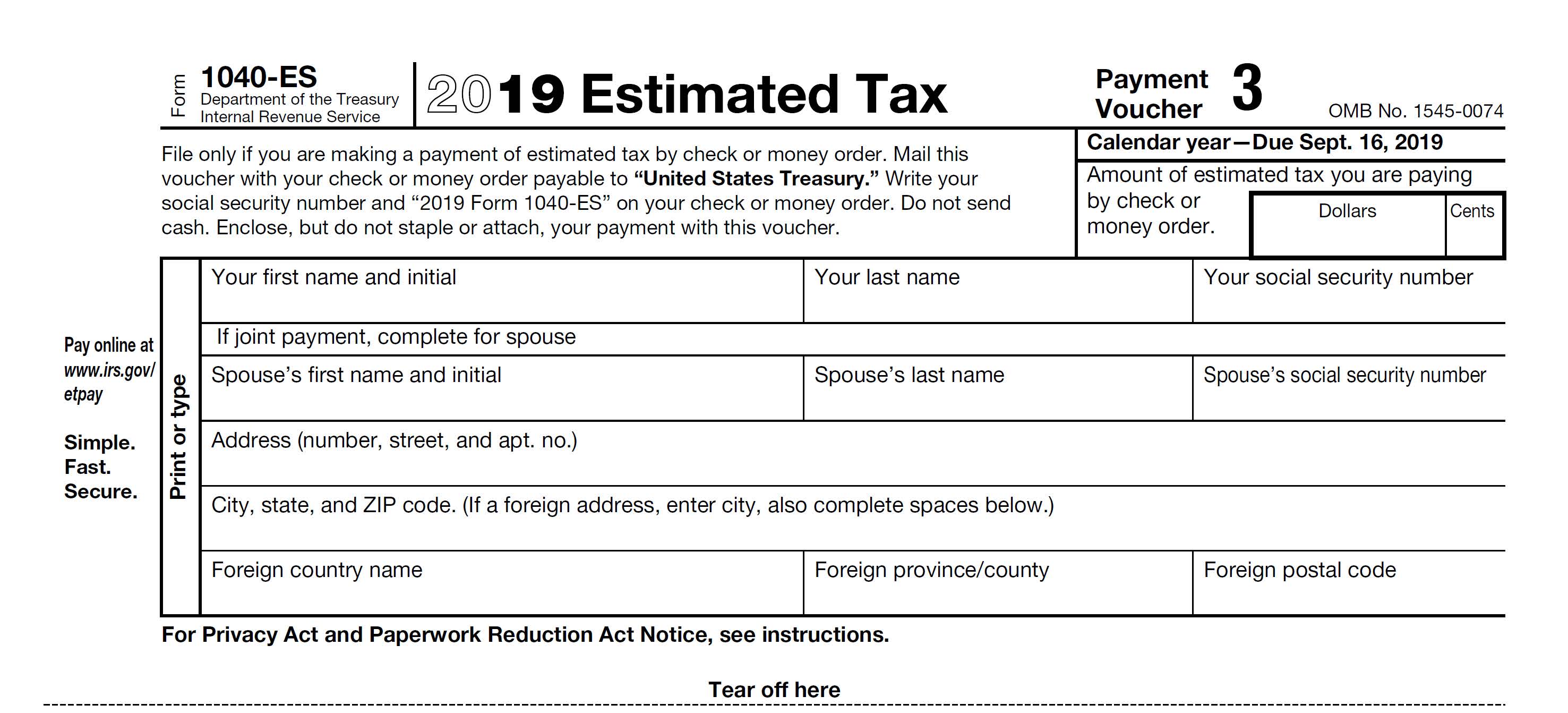

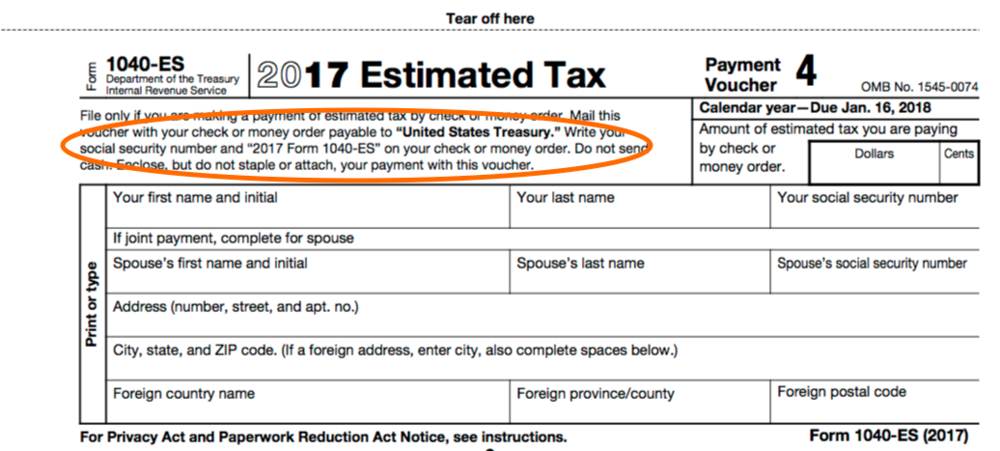

Irs quarterly payment coupon. Publication 505 (2022), Tax Withholding and Estimated Tax If a 2022 Form W-4P is used for withholding for payments beginning in 2022, and you don't give the payer your SSN in the required manner or the IRS notifies the payer before any payment or distribution is made that you gave an incorrect SSN, tax will be withheld as if your filing status is single, with no adjustments in Steps 2 through 4. 2022 Form 1040-ES - IRS tax forms Go to IRS.gov/Payments to see all your payment options. General Rule In most cases, you must pay estimated tax for 2022 if both of the following apply. 1. You expect to owe at least $1,000 in tax for 2022, after subtracting your withholding and refundable credits. 2. You expect your withholding and refundable credits Publication 550 (2021), Investment Income and Expenses ... Comments and suggestions. We welcome your comments about this publication and suggestions for future editions. You can send us comments through IRS.gov/FormComments.Or, you can write to the Internal Revenue Service, Tax Forms and Publications, 1111 Constitution Ave. NW, IR-6526, Washington, DC 20224. Payments | Internal Revenue Service - IRS tax forms 4 oct. 2022 · Pay your taxes, view your account or apply for a payment plan with the IRS. Service Outages: Check Back Later This service is having outages that may keep you from successfully completing your session. Check back later. ... Employer's Quarterly Federal Tax Return Form W-2; Employers engaged in a trade or business who pay compensation

Publication 17 (2021), Your Federal Income Tax | Internal ... See payment plan details or apply for a new payment plan. Make a payment, view 5 years of payment history and any pending or scheduled payments. Access your tax records, including key data from your most recent tax return, your economic impact payment amounts, and transcripts. View digital copies of select notices from the IRS.

Post a Comment for "38 irs quarterly payment coupon"