40 present value of coupon bond

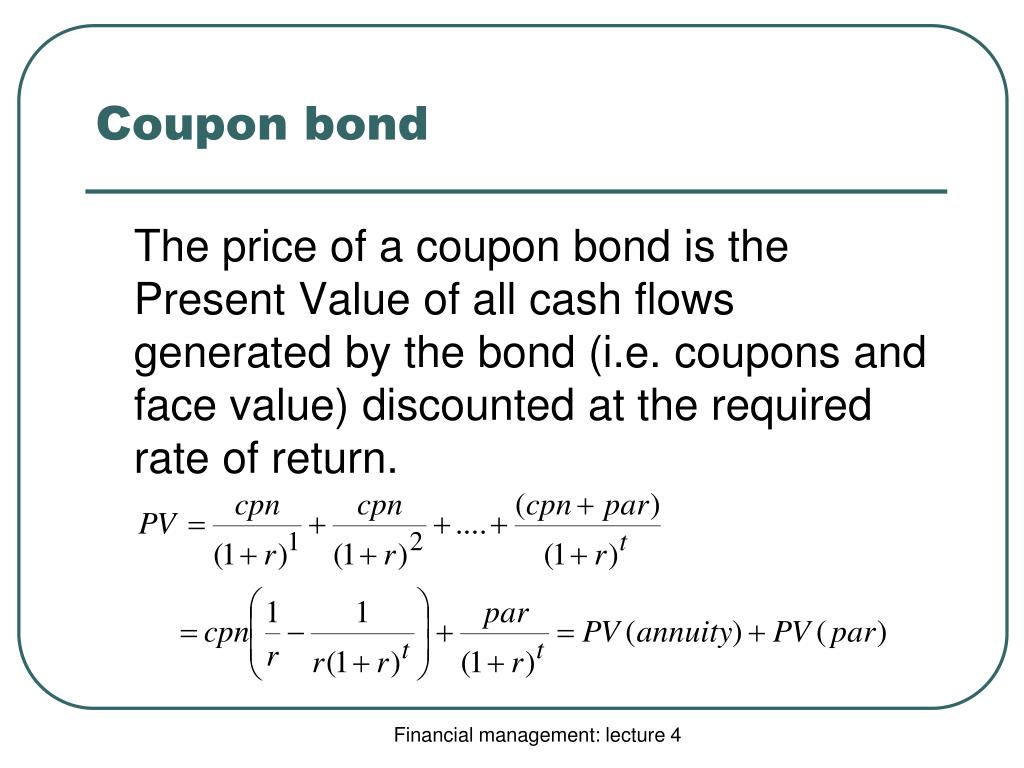

How to Calculate the Price of Coupon Bond? - WallStreetMojo The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] Answered: What is the present value of a… | bartleby Q: A building acquired at the beginning of the year at a cost of $119,600 has an estimated residual…. A: Double Declining Balance rate is calculated using a useful life of the asset. DDB rate = 200 /…. Q: Lee Company acquired 75% of Winters Company for $600,000 on January 1, 2020. Winters reported common….

Coupon Bond: Definition, How They Work, Example, and Use Today This means the investor gets $50, the face value of the bond derived from multiplying $1,000 by 0.05, every year. For the investor to claim his interest on the bond, he simply takes the...

Present value of coupon bond

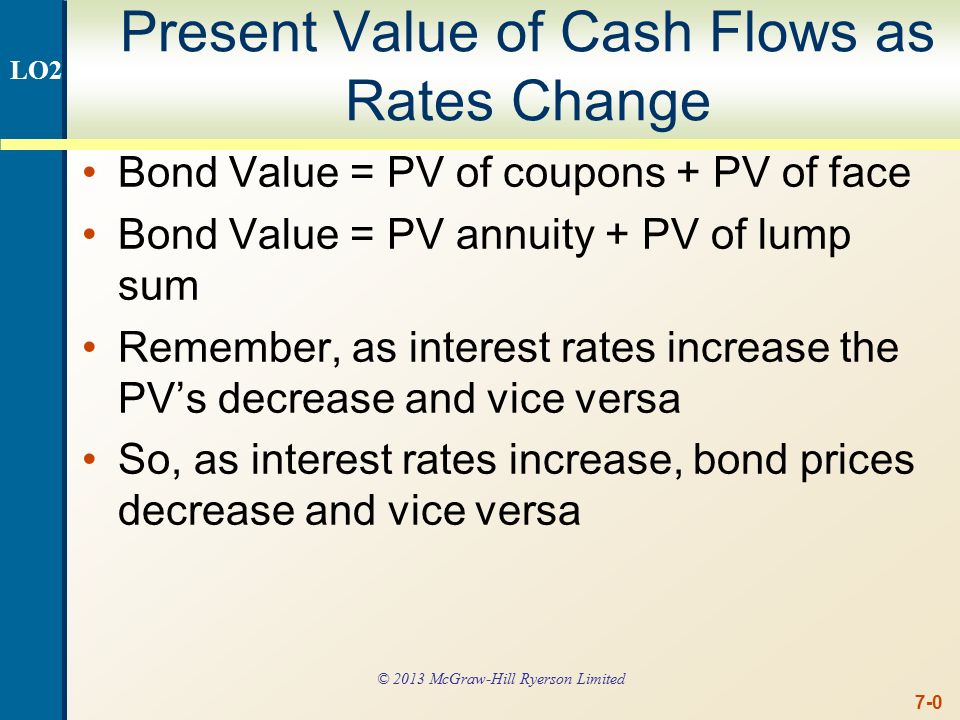

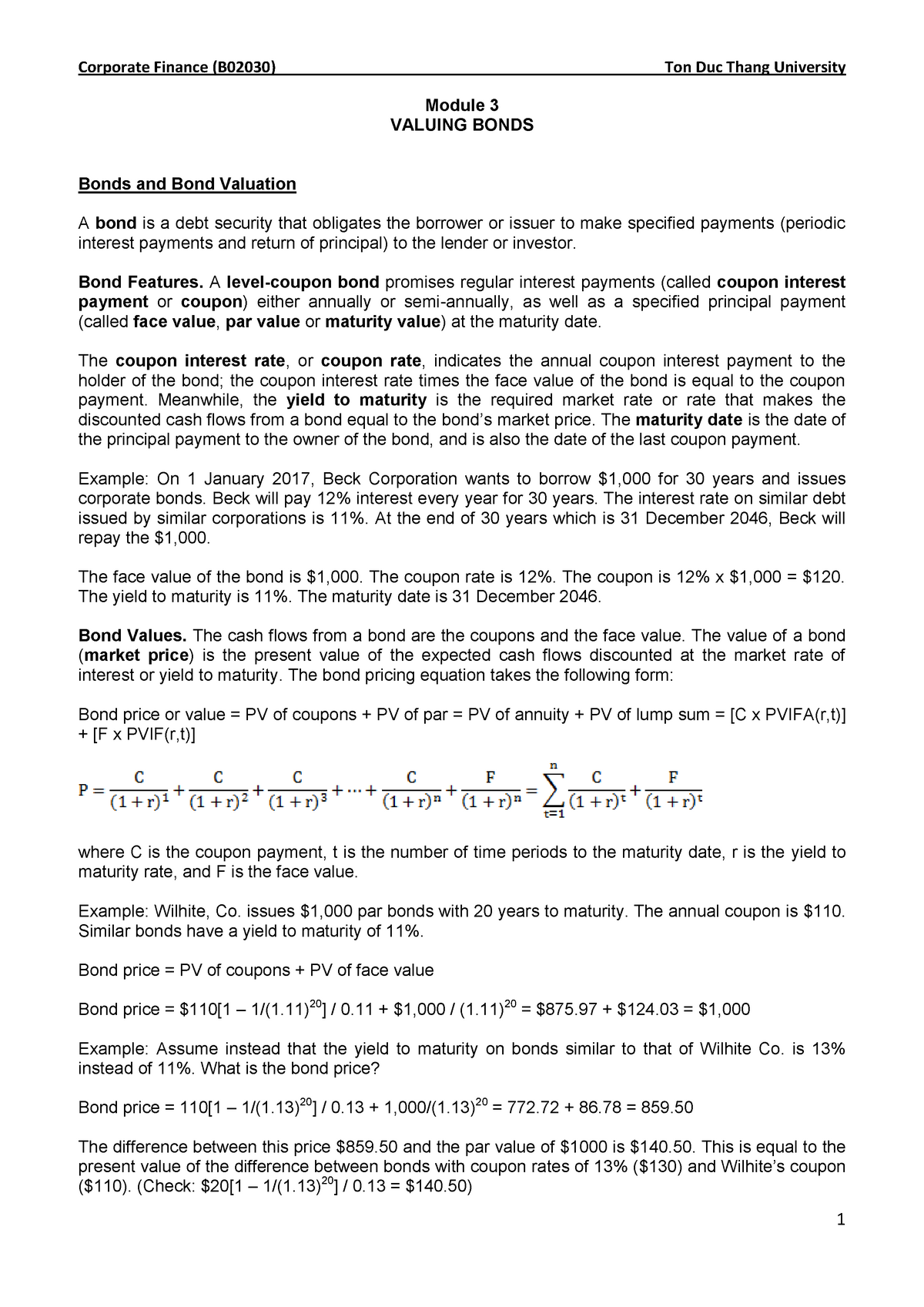

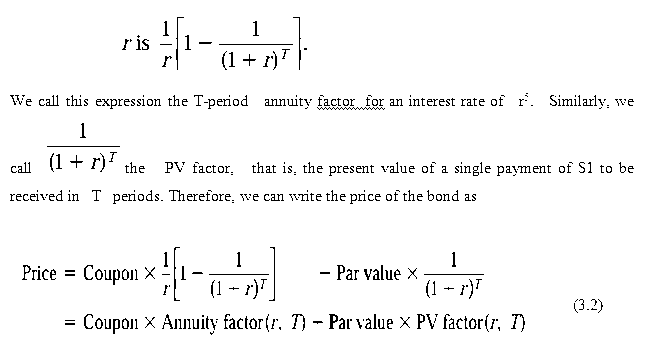

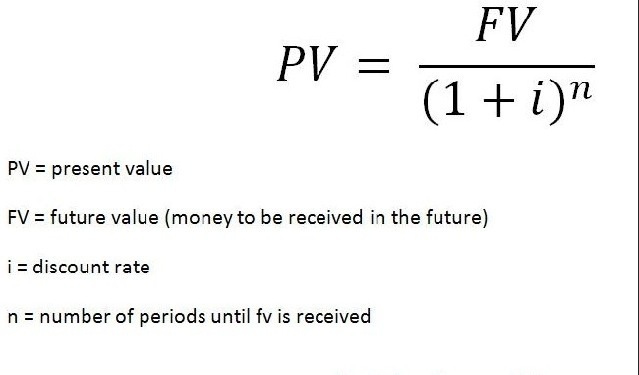

Bond Pricing Formula | How to Calculate Bond Price? | Examples The formula for bond pricing is the calculation of the present value of the probable future cash flows, which comprises the coupon payments and the par value, which is the redemption amount on maturity. The rate of interest used to discount the future cash flows is known as the yield to maturity (YTM.) Bond Price = ∑i=1n C/ (1+r)n + F/ (1+r)n ... Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Solved 1. The present value of a bond is the sum of its | Chegg.com (Note: A"zero-coupon" bond is one where C = 0 and so a investor receives indirect interest as the difference between the bond's maturity value and its purchase price.) Suppose first that you want to find the price of a 20-year 10% coupon bond with a par value of $1, 000. Suppose that the required yield is 11% per year.

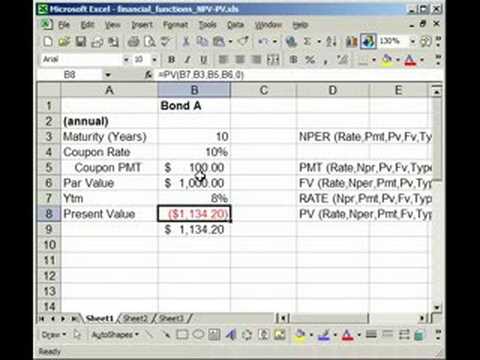

Present value of coupon bond. How to Calculate the Present Value of a Bond | Pocketsense The final period usually coincides with the maturity date. Required Rate (Rate): the interest rate per coupon period demanded by investors. The formula for determining the value of a bond uses each of the four factors, and is expressed as: Bond Present Value = Pmt/ (1+Rate) + Pmt/ (1+Rate) 2 + ... +Pmt/ (1+Rate) Nper + Fv/ (1+Rate) Nper. Bond Coupon Interest Rate: How It Affects Price - Investopedia For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. But if a bond's coupon ... Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... If 30-year interest rates are 14% a person would only need to spend $17,257.32 to buy a $1,000,000 face-value zero coupon bond. With interest rates at 3% that math changes drastically, requiring a $409,295.97 payment to buy the same instrument. That difference in price is capital appreciation. How to Calculate PV of a Different Bond Type With Excel - Investopedia The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a...

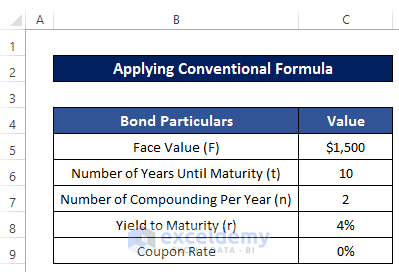

Coupon Bond Formula | Examples with Excel Template - EDUCBA Coupon Bond is calculated using the Formula given below. Coupon Bond = C * [1 - (1+Y/n)-n*t/ Y ] + [ F/ (1+Y/n)n*t] Coupon Bond = $50 * [1 - (1 + 6%/1) -1*9] + [$1000 / (1 + 6%/1) 1*9 Coupon Bond = $932 What Is a Bond Coupon, and How Is It Calculated? - Investopedia If the bond later trades for $900, the current yield rises to 7.8% ($70 ÷ $900). The coupon rate, however, does not change, since it is a function of the annual payments and the face value,... How do you find the present value of a coupon bond? To find the zero coupon bond's value at its original price, the yield would be used in the formula. After the zero coupon bond is issued, the value may fluctuate as the current interest rates of the market may change. How is the present value of a coupon calculated? The present value is computed by discounting the cash flow using yield to ... Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. ... As mentioned above, the bond price is the net present value of the cash flow generated by the bond and can be calculated using the bond price equation below:

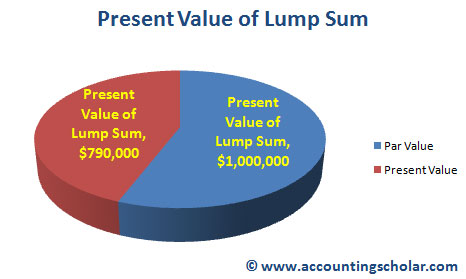

Coupon Bond | Coupon Bond Price | Examples of Coupon Bond - EDUCBA The formula for CB is derived based on the sum of the present value of all the future cash inflows either in the form of coupons or principal at maturity. ... The par value of the bond is $1,000, coupon rate of 6%, and a number of years until maturity in 6 years. Determine the price of the CB if the yield to maturity is 7%. Solution: Given,Par ... Bond Formula | How to Calculate a Bond | Examples with Excel Template The term "bond formula" refers to the bond price determination technique that involves computation of present value (PV) ... Let us take the example of another bond issue by SDF Inc. that will pay semi-annual coupons. The bonds have a face value of $1,000 and a coupon rate of 6% with maturity tenure of 10 years. Calculate the price of each ... How to Calculate Present Value of a Bond - Pediaa.Com Step 1: Calculate Present Value of the Interest Payments Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond F = Face value of the bond R = Market t = Number of time periods occurring until the maturity of the bond Step 2: Calculate Present Value of the Face Value of the Bond Bond Valuation: Calculation, Definition, Formula, and Example Present value of face value = 1000 / (1.015) 4 = 942.18 Therefore, the value of the bond is $1,038.54. Zero-Coupon Bond Valuation A zero-coupon bond makes no annual or semi-annual...

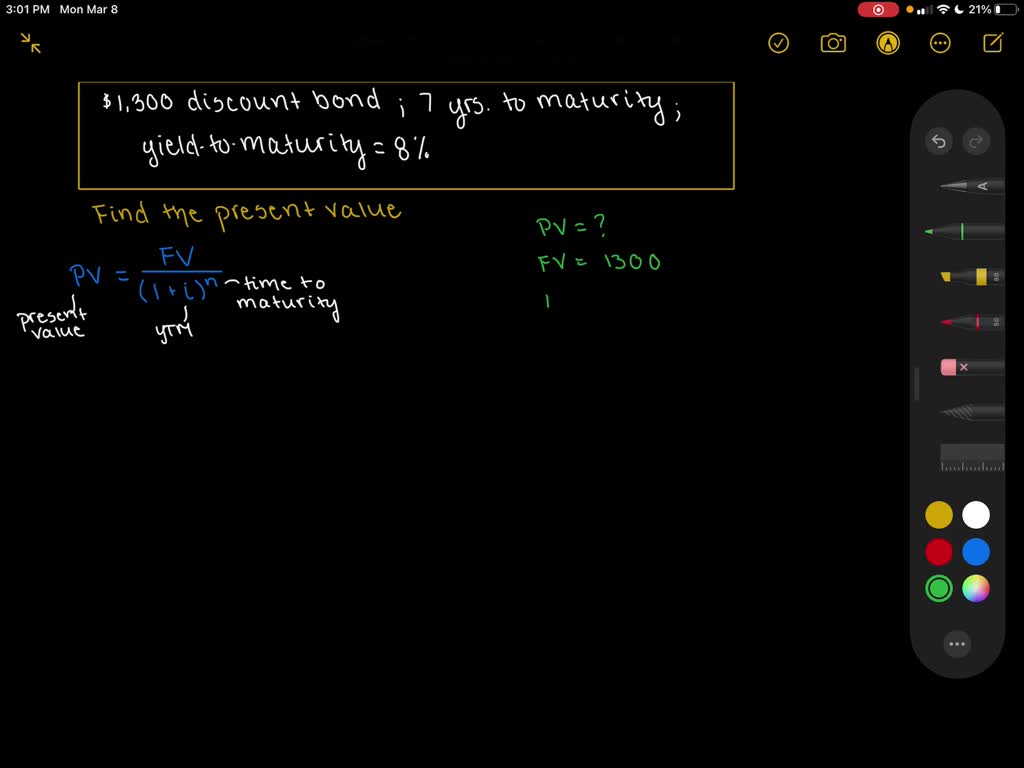

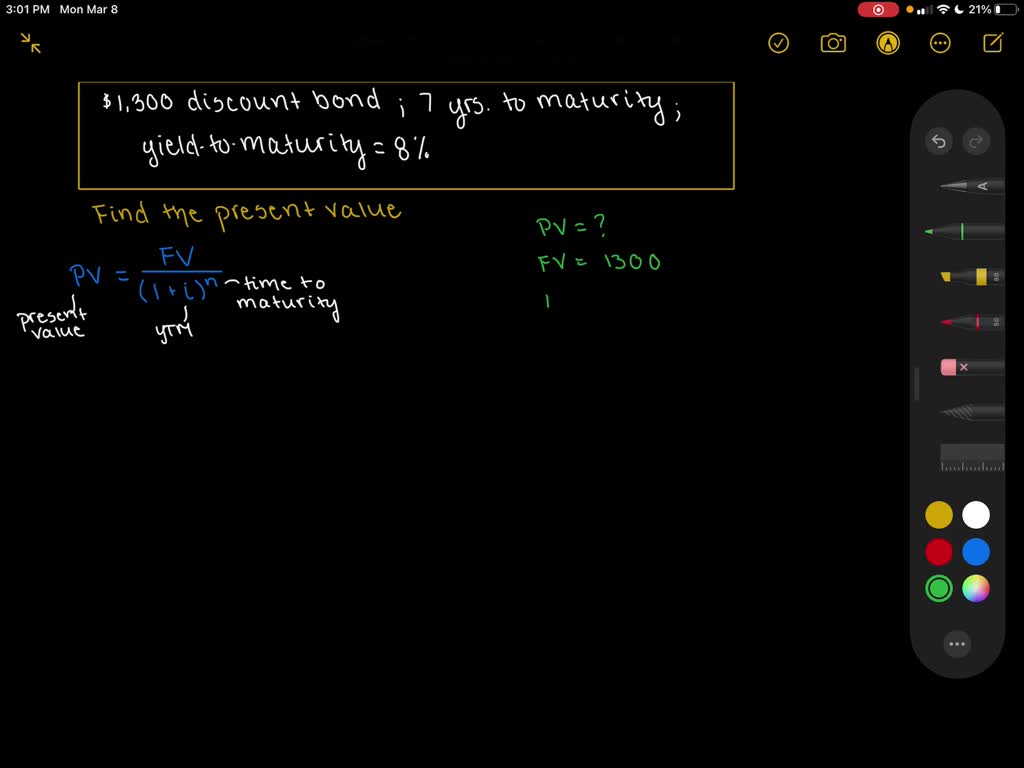

Calculate the present value of a 1,300 discount bond with seven years to maturity if the yield to maturity is 8 %.

Bond Present Value Calculator The calculator, uses the following formulas to compute the present value of a bond: Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ^ Number Payments Present Value of Interest Payments = Payment Value * (1 - (Market Rate / 100) ^ -Number Payments) / Number Payments)

How to calculate the present value of a bond — AccountingTools Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor. Go to a present value of an ordinary annuity table and locate the present value of the stream of interest payments, using the 8% market rate. This amount is 3.9927.

Coupon Bond - Guide, Examples, How Coupon Bonds Work If there is a high probability of default, investors may require a higher rate of return on the bond. Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate i = Interest rate n = number of payments

Solved 1. The present value of a bond is the sum of its | Chegg.com (Note: A"zero-coupon" bond is one where C = 0 and so a investor receives indirect interest as the difference between the bond's maturity value and its purchase price.) Suppose first that you want to find the price of a 20-year 10% coupon bond with a par value of $1, 000. Suppose that the required yield is 11% per year.

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Bond Pricing Formula | How to Calculate Bond Price? | Examples The formula for bond pricing is the calculation of the present value of the probable future cash flows, which comprises the coupon payments and the par value, which is the redemption amount on maturity. The rate of interest used to discount the future cash flows is known as the yield to maturity (YTM.) Bond Price = ∑i=1n C/ (1+r)n + F/ (1+r)n ...

Post a Comment for "40 present value of coupon bond"