43 t bill coupon rate

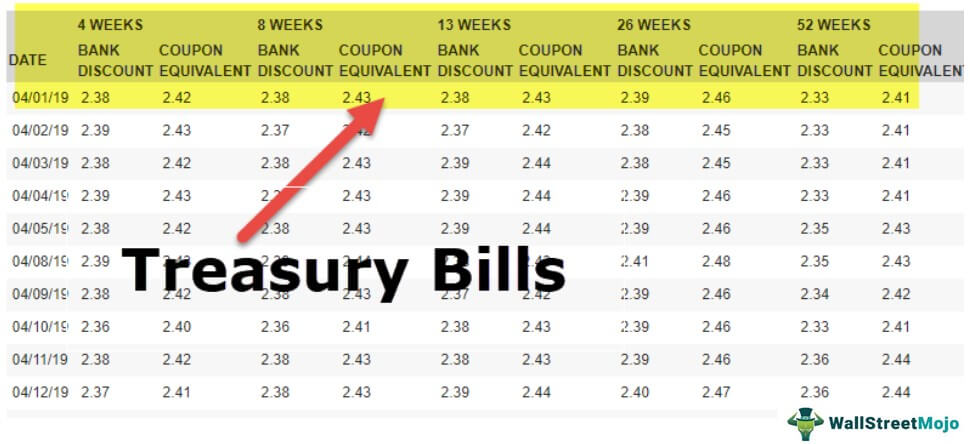

TMUBMUSD06M | U.S. 6 Month Treasury Bill Overview | MarketWatch Coupon Rate 0.000%; Maturity May 25, 2023; Performance. 5 Day: 4.78; 1 Month: 11.68; 3 Month: ... Most Treasury yields fell on Thursday, while rates on 3- and 6-month Treasury bills swung in both ... Treasury Bills (T-Bills) - Meaning, Examples, Calculations - WallStreetMojo For example, The US Federal Treasury Department issued 52week T-Bills at a discounted rate of $97 per bill at face value of $100. An investor purchases 10 T-Bills at a competitive bid price of $97 per bill and invests a total of $970. After 52 weeks, the T bills matured.

Reserve Bank of India - NSDP Display NSDP. (11 kb) or (149 kb) Date : Nov 18, 2022. Cash Reserve Ratio and Interest Rates. (per cent) Item/Week Ended. 2021. 2022.

T bill coupon rate

NASDAQ - Datastore NASDAQ - Datastore Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to... Treasury Bills - Guide to Understanding How T-Bills Work The amount of profit earned from the payment is considered the interest earned on the T-bill. The difference between the face value of the T-bill and the amount that an investor pays is called the discount rate, which is calculated as a percentage. In this case, the discount rate is 5% of the face value.

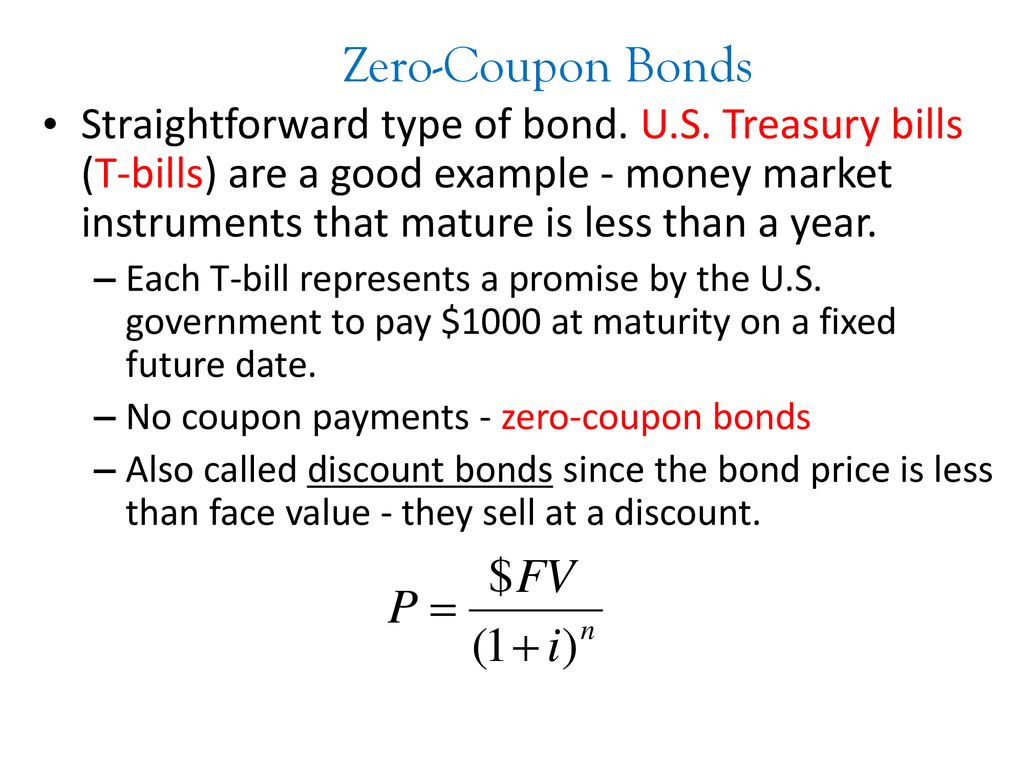

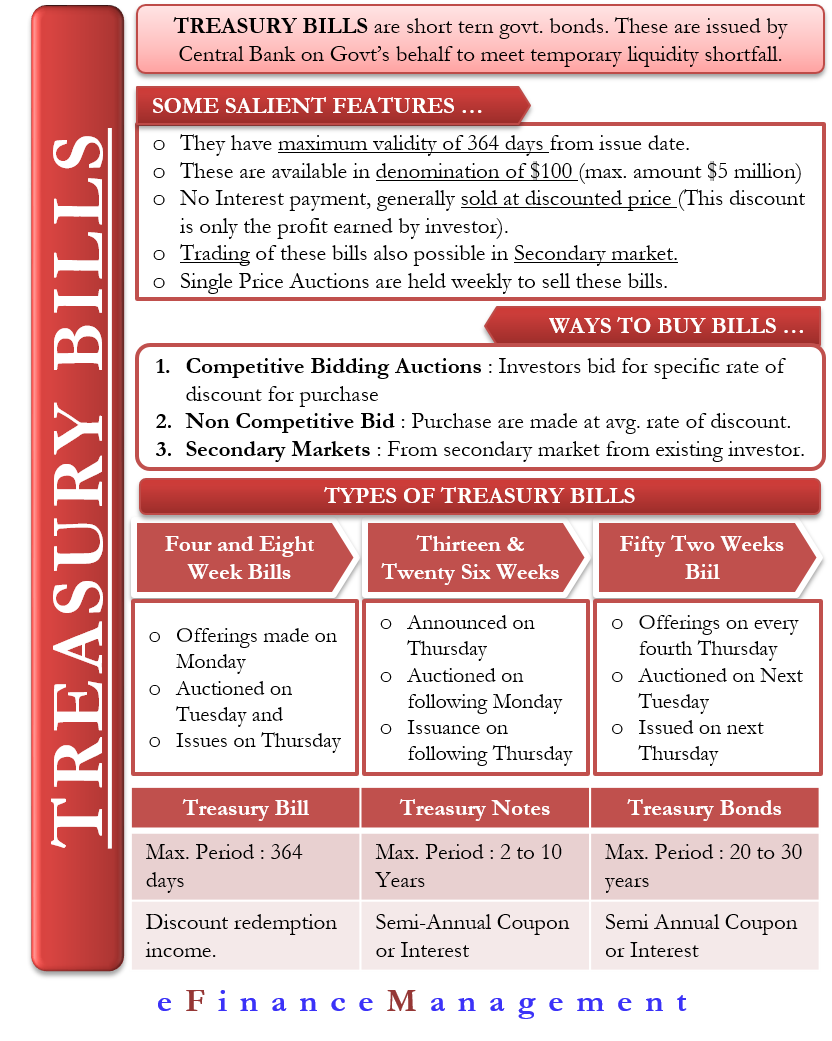

T bill coupon rate. 13-Week T-Bill Rate Cash (TBY00) - Barchart.com 13-Week T-Bill Rate Prices The All Futures page lists all open contracts for the commodity you've selected. Intraday futures prices are delayed 10 minutes, per exchange rules, and are listed in CST. Overnight (Globex) prices are shown on the page through to 7pm CT, after which time it will list only trading activity for the next day. Are T-Bills "coupon equivalent" rates based in annual terms? 1 According to treasury.gov, the "coupon equivalent" for a 1 month (4 weeks) T-Bill issued today is 0.99%. I happened to have purchased a 1 month T-Bill today for $99.9246. By my calculation that means that the return will be .075% (.0754/99.9246) for the month. Your Money: How rate of return on T-Bills is calculated The discount is (100 x 0.06 x 108 ÷ 360) = 1.80. Thus, the price will be quoted as Rs 100 - Rs 1.80 = Rs 98.20. The quoted rate is called the discount rate. In the case of other securities, the ... What Are Treasury Bills (T-Bills) and How Do They Work? - Investopedia T-bills are short-term government debt instruments with maturities of one year or less, and they are sold at a discount without paying a coupon. T-Notes represent the medium-term maturities...

Coupon Rate - Learn How Coupon Rate Affects Bond Pricing Formula for Calculating the Coupon Rate Where: C = Coupon rate i = Annualized interest P = Par value, or principal amount, of the bond Download the Free Template Enter your name and email in the form below and download the free template now! How the Coupon Rate Affects the Price of a Bond All types of bonds pay interest to the bondholder. Treasury Bills — TreasuryDirect Treasury Bills. We sell Treasury Bills (Bills) for terms ranging from four weeks to 52 weeks. Bills are sold at a discount or at par (face value). When the bill matures, you are paid its face value. You can hold a bill until it matures or sell it before it matures. Note about Cash Management Bills: We also sell Cash Management Bills (CMBs) at ... Interest Rate Statistics | U.S. Department of the Treasury To estimate a 30-year rate during that time frame, this series includes the Treasury 20-year Constant Maturity rate and an "adjustment factor," which may be added to the 20-year rate to estimate a 30-year rate during the period of time in which Treasury did not issue the 30-year bonds. Detailed information is provided with the data What Are Treasury Bills (T-Bills), and Should You Invest ... - SmartAsset Let's say you purchase a $10,000 T-bill with a discount rate of 3% that matures after 52 weeks. That means you pay $9,700 for the T-bill upfront. Once the year is up, you get back your initial investment plus another $300. If you're interested in investing in T-bills, make sure you aren't looking at treasury bonds or treasury notes.

Should You Buy Treasuries? - Forbes For example, assume you buy a one-year T-bill with a $1 million par value and a 2% yield to maturity. When the bill matures, your total dollar return is roughly $20,000. 91 Day T Bill Treasury Rate - Bankrate The difference between the discounted price and the face value determines the yield. The yield on 91-day Treasury bills is the average discount rate. How it's used: The rate is used as an... United States Rates & Bonds - Bloomberg Find information on government bonds yields, muni bonds and interest rates in the USA. ... Coupon Price Yield 1 Month 1 Year Time (EST) GB3:GOV . 3 Month . 0.00: 4.22: 4.32% +27 +430: 12:19 AM: Treasury Bills vs Bonds | Top 5 Differences (with Infographics) Coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more: T-bills do not pay any coupon.

Treasuries - WSJ Treasury Notes & Bonds. Treasury Bills. Treasury note and bond data are representative over-the-counter quotations as of 3pm Eastern time. For notes and bonds callable prior to maturity, yields ...

Understanding Pricing and Interest Rates — TreasuryDirect To see what the purchase price will be for a particular discount rate, use the formula: Price = Face value (1 - (discount rate x time)/360) Example: A $1,000 26-week bill sells at auction for a discount rate of 0.145%. Price = 1000 (1 - (.00145 x 180)/360) = $999.27 The formula shows that the bill sells for $999.27, giving you a discount of $0.73.

US Treasury Bill Calculator [ T-Bill Calculator ] The annual percentage profit rate based the period of the treasury bill investment The annual interest rate of your T-Bill is calculated for information only. For example, you buy a $5000 T-Bill for $4800 over three months. Your profit is $200, the rate of return is 4.17% Calculations can be saved to a table by clicking the "Add to table" button

TMUBMUSD01Y | U.S. 1 Year Treasury Bill Overview | MarketWatch Coupon Rate 0.000% Maturity Nov 30, 2023 Performance Change in Basis Points Yield Curve - US Recent News MarketWatch Dow ends over 700 points higher to exit bear market after Powell signals...

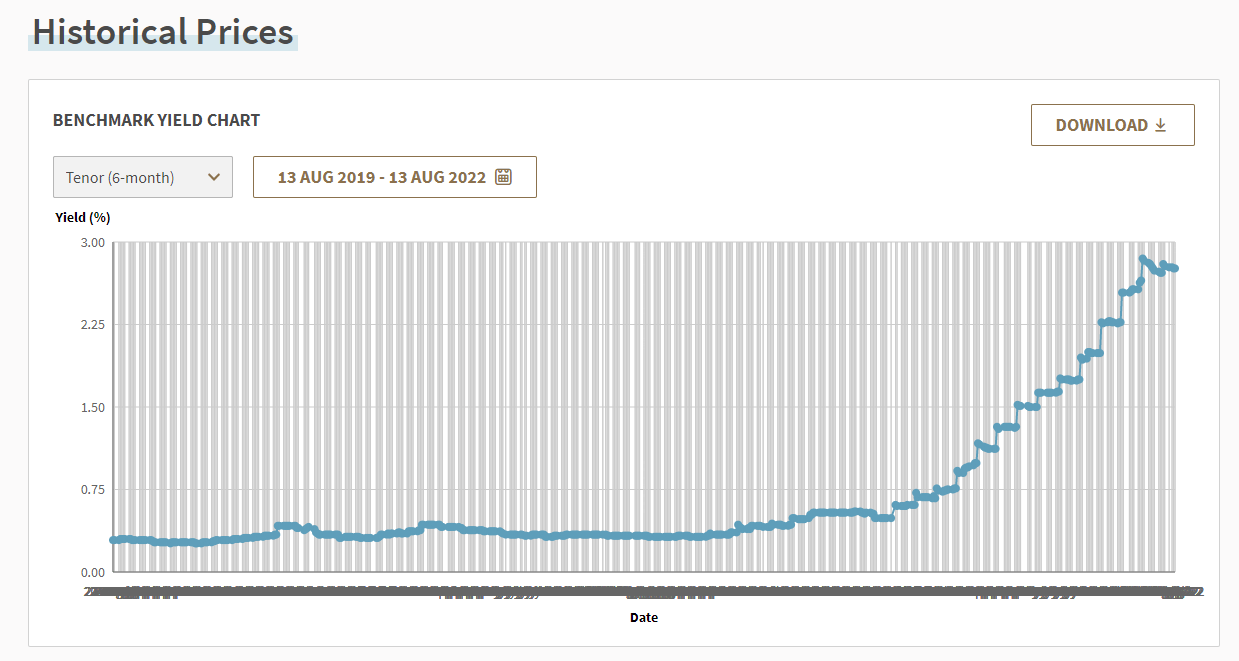

Treasury Bills Statistics - Monetary Authority of Singapore SGS T-bill Yield Curve. 6 12 Tenor (Months) 2.870 2.875 2.880 2.885 2.890 Yield (%) Latest Yield. Previous Week.

US Treasury Bonds - Fidelity The coupon rate is fixed at the time of issuance and is paid every six months. Other Treasury securities, such as Treasury bills (which have maturities of one year or less) or zero-coupon bonds, do not pay a regular coupon. Instead, they are sold at a discount to their face (or par) value; investors receive the full face value at maturity.

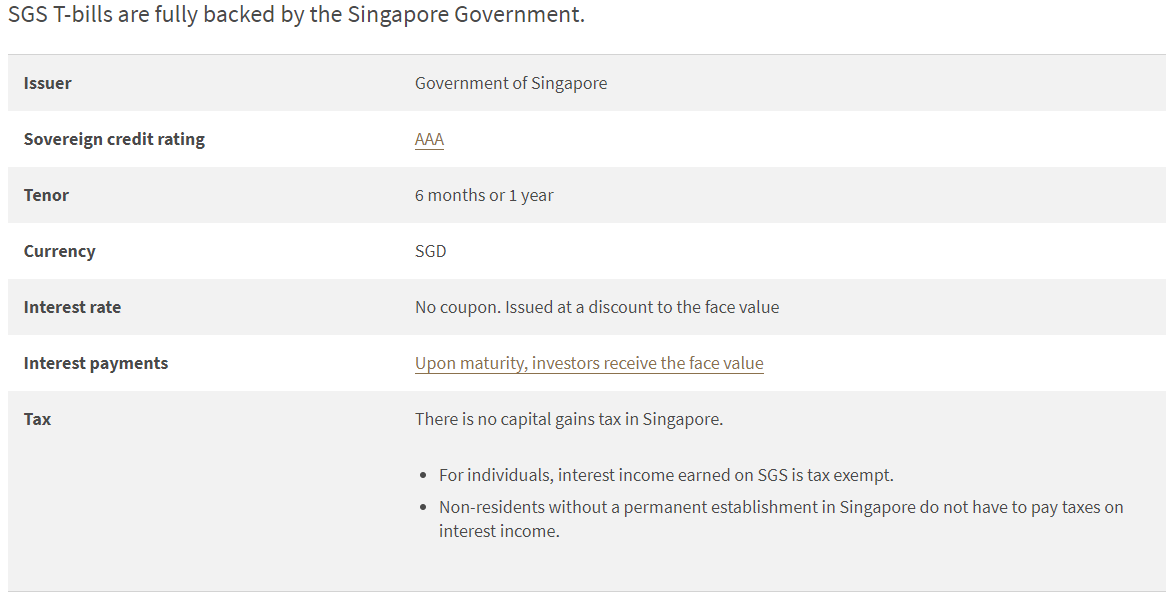

T-bills: Information for Individuals - Monetary Authority of Singapore T-bills: Information for Individuals Treasury bills (T-bills) are short-term Singapore Government Securities (SGS) issued at a discount to their face value. Investors receive the full face value at maturity. The Government issues 6-month and 1-year T-bills. Overview AAA Credit Rating Min. $1,000 Investment Amount Buy with Cash, SRS and CPF Funds

Treasury Coupon Issues | U.S. Department of the Treasury Daily Treasury Bill Rates. ... "The Yield Curve for Treasury Nominal Coupon Issues" by James A. Girola - 5/16/2014 "The Treasury Real Yield Curve and Breakeven Inflation" by James A. Girola - 7/21/2015 "Treasury Yield Curves and Discount Rates" by James A. Girola - 2/27/2016

6 Month Treasury Bill Rate - YCharts 6 Month Treasury Bill Rate is at 4.57%, compared to 4.54% the previous market day and 0.10% last year. This is higher than the long term average of 4.48%. Stats

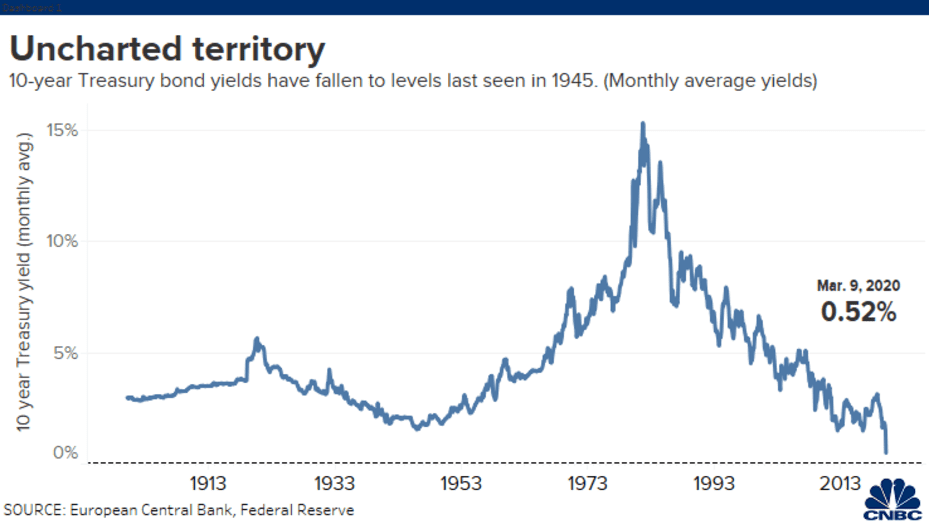

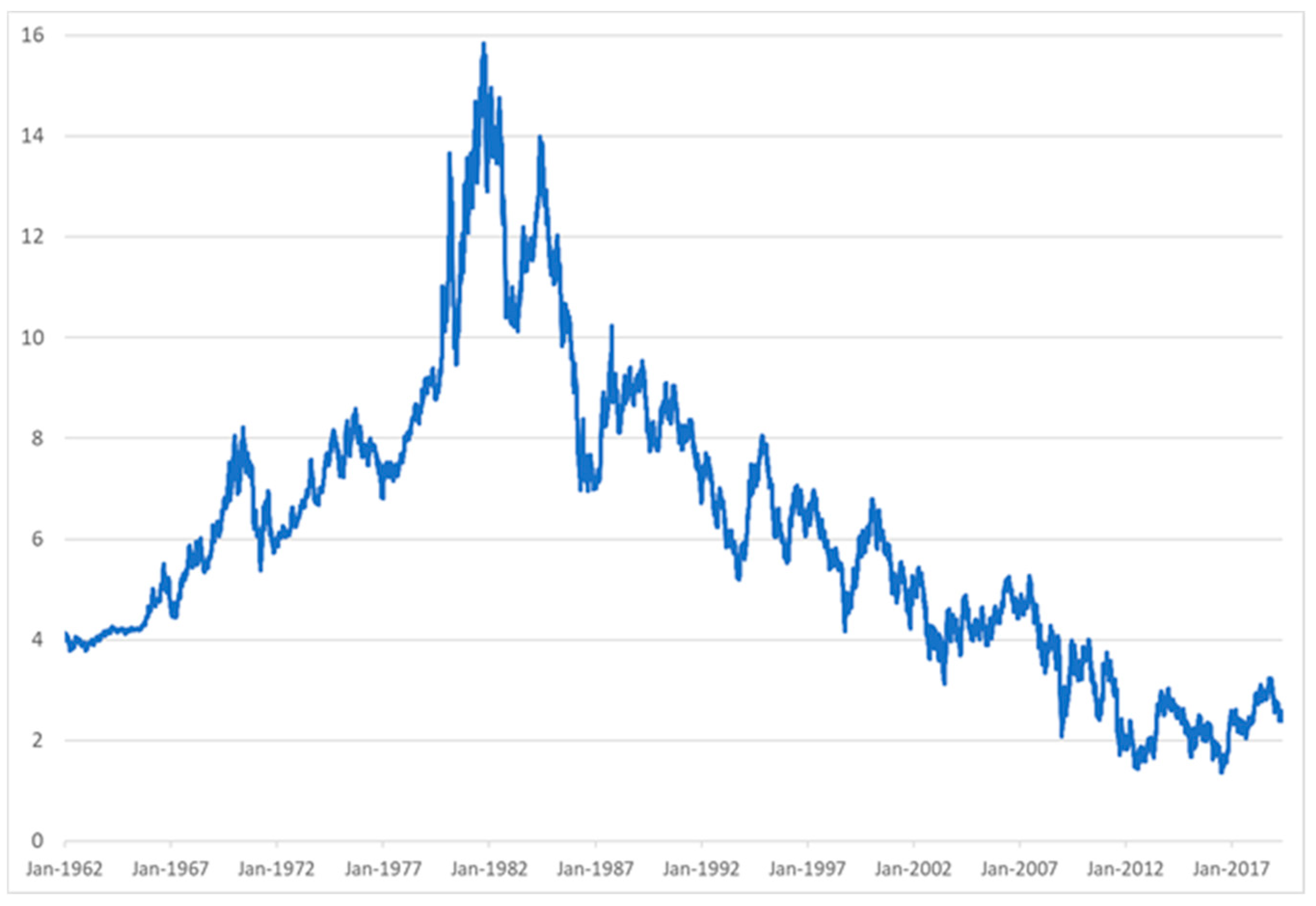

3 Month Treasury Bill Rate - YCharts The 3 month treasury yield hovered near 0 from 2009-2015 as the Federal Reserve maintained its benchmark rates at 0 in the aftermath of the Great Recession. 3 Month Treasury Bill Rate is at 4.30%, compared to 4.22% the previous market day and 0.06% last year. This is higher than the long term average of 4.17%. Stats Related Indicators

US T-Bill Calculator | Good Calculators The annual interest that is calculated, is calculated for the information only. For example, if you were to buy a T-Bill of $10,000 for $9,900 over a period of 13 weeks then you would have a profit of $100 and a rate of return of 1.01% US Treasury Bills Calculator Face Value of Treasury Bill, $: Other Value, $: Maturity Period: Other Period:

Treasury Bills - Guide to Understanding How T-Bills Work The amount of profit earned from the payment is considered the interest earned on the T-bill. The difference between the face value of the T-bill and the amount that an investor pays is called the discount rate, which is calculated as a percentage. In this case, the discount rate is 5% of the face value.

Coupon Rate Definition - Investopedia The coupon rate, or coupon payment, is the nominal yield the bond is stated to pay on its issue date. This yield changes as the value of the bond changes, thus giving the bond's yield to...

NASDAQ - Datastore NASDAQ - Datastore

:max_bytes(150000):strip_icc()/treasurynotes-bills-and-bonds-3305609-finalv42-fc941b4ff55d4247951067ef742a406b.png)

:max_bytes(150000):strip_icc()/Treasury-yield_final-40eecf2eabbe467da15e4b7d7ea949ff.png)

![1. [20 points] You observe the following Treasury | Chegg.com](https://media.cheggcdn.com/media/e27/e270d5a8-78a8-4494-b4e5-34ea83f2212f/php46N91z.png)

Post a Comment for "43 t bill coupon rate"